Forex Majors

Forex Introduction

FOREIGN EXCHANGE or FOREX is the largest, most liquid market, with a sum of $6.6 trillion daily turnovers assembled through the MT5 electronic trading platform 24 hours a day - 5 days a week using friendly software with high leverage and liquidity providing easy entry and exit.

Starting from Asia, Europe, and America, and forming the shape of a golden triangle.

FX/FOREX/SPOT market allows you to Buy and Sell currencies against each other, as well as Metals, Energies, Commodities and speculate in the exchange rates. Making a transaction on the Foreign Exchange Market is simple: the procedures are identical to that of any other market so switching to trading currencies is straightforward for most traders.

FxGrow offers online forex trading services for traders wanting to make speculative and investment transactions on the exchange rate. These rates may be influenced by world economic and political events, currency rate differentials, as well as many other factors including weather conditions, acts of war…

The Foreign Exchange Market also called the IMM (International Money Markets), is the largest market place in the world with more than 5.3 trillion dollars changing hands daily and so making it one of the most attractive and lucrative markets

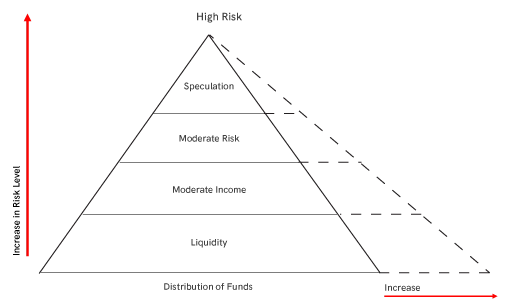

In Forex, margin is the minimum required balance to place a trade. When you open a Forex trading account, money you deposit acts as collateral for your trades. This deposit, called margin, is typically %1 of the value of the position.

For example, if you want to purchase 100,000$ of USD/JPY at 100:1 leverage, the money required is %1, or 1000$. The other 99,000$ is collateralized with your remaining account balance

It is very important to remember that leverage magnifies your profit and losses. You should monitor your account balance on a regular basis and utilize stop loss orders on every position to limit downside risk.

However, leverage is an exceptionally good tool that can be utilized to increase your buying power and return on capital - as long as you have a solid risk management in place.