Market Mechanism

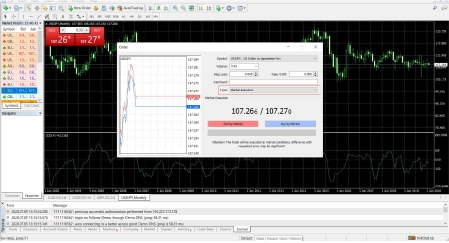

Types of Forex Orders

A market order is an order to buy or sell a certain contract immediately. This type of order guarantees that the order will be executed on the spot. A market order generally will execute at or near the current bid (for a sell order) or ask (for a buy order) price.

- Executed immediately based on 'bid' and 'ask'

- BID is the price a buyer is willing to pay for an asset

- ASK is the price a seller is willing to accept for an asset

- Spread is the difference between the Bid and Ask

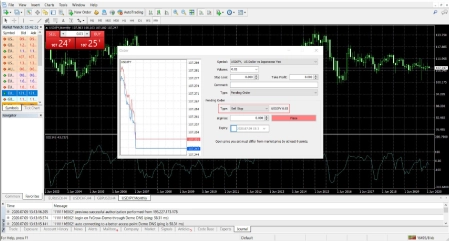

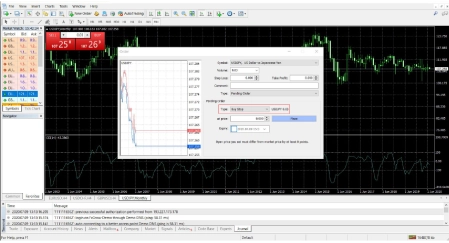

Limit Order

An order to buy or sell at a target price or better

1- Placing a limit order to Buy at a price lower than the current market price

Buy Limit

2- Placing a limit order to Sell at a price higher than the current market price

Sell Limit

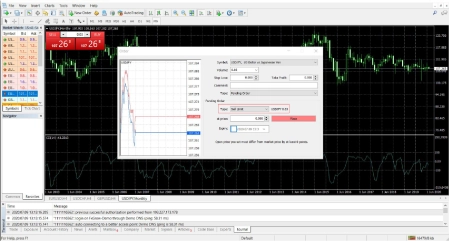

Stop Market Order

Triggered at specified price, executed at market and

1- Placing an order to Buy at a price higher than the current price, also called a Buying zone

Buy Stop

2- - Placing an order to Sell at a price lower than the current price, also called a Selling zone.

Sell Stop